2025 and the housebuilding supply chain – The Ups, the Downs, Causes for Optimism, oh, and by the way…

Understanding the market and the environment in which we operate is vital for the housebuilding supply chain. Keeping up with the pace of change can be all-consuming.

Understanding the market and the environment in which we operate is vital for the housebuilding supply chain. Keeping up with the pace of change can be all-consuming.

So this month, we’re weighing up a list of pro’s and con’s. What’s going well, what’s not as healthy. Not that we have the answers, but it’s useful to know what the questions are!

On the up

Demand from UK housebuilding rose in January, with a reasonably healthy increase in call offs received by Scotts Timber Engineering to sites across the country, large and small.

And the Chancellor Reeves claims to be reducing the environmental requirements placed on developers, when they pay into a nature restoration fund have created so they can focus on getting things built.

This is in line with the Construction Products Association’s latest forecasts published at the end of January, that output in 2025 and 2026 is likely to be an improvement on 2023 and

2024.

Not so hot

We do however also echo the CPA’s concern’s about forecasted slower (if any) economic growth and fewer-than expected interest rate cuts. Focusing purely on housebuilding rather than the broader construction industry, we see other concerns that may restrain build programmes despite the Chancellor’s speech on 29th January:

- 80% of Council Planning Departments are operating below capacity) – averaging around 7 FTE planning officers short per council and with department underperforming as a result, the Government’s proposal for an addition 300 staff is just 15% of what is needed. (Source: https://www.hbf.co.uk/documents/14186/Planning_on_empty_report.pdf

- 28% of SME building contractors cited difficulties recruiting general on-site trades in the last quarter of last year (Source: CPA)

- 17,400 affordable homes in Englandand Wales with planning permission cannot be built because housing associations do not have the financial capacity to bid for them. (Source (HBF)

- Higher mortgage borrowing costs (30th Jan: 2 year fix 5.01% and 5 year fix 4.81%, source: Rightmove) may affect demand.

- The number of jobs that will be lost to the economy in April as the effects of the rise in employer NI contributions kicks in (you only have to read the news to see that many thousands have already been announced) is expected to affect consumer spending and demand across the board, including housing.

This leaves us with two key questions:

- Even if housebuilders get planning permissions and find the staff, will they continue to build new homes only at the rate they can sell them? It sounds like common sense to us, but what’s being done to improve consumer confidence?

- How many housebuilders and suppliers to the construction business, many with already-constrained cashflow, will struggle to weather the belt-tightening impact of the Government’s budget? It’s a challenge for businesses in every sector, and it’s not clear how or whether Government policy will genuinely move in the direction of ‘business friendly’

Yes, we do keep asking the same questions, but so far, we don’t see any clear answers.

So we look for cause for optimism wherever we can find it:

As we moved into 2025, we decided to look for reasons for the housebuilding sector to be cheerful.

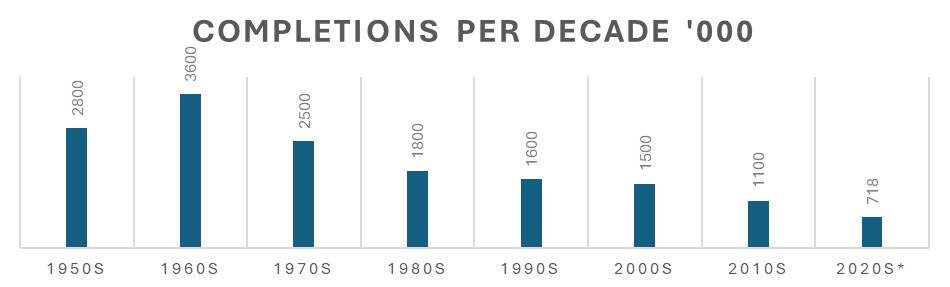

Choosing to lift our eyes in order to lift our spirits, we studied long terms trends in total homes built by decade going back to the 1950’s from the ONS.

And WOW look what we found out about how many thousands of homes have been built by decade!:

(It being Dry January when we were looking at the numbers, we then took a policy decision not to just sit back and cry for the 1960’s)

Optimism? Yes. We’re only halfway through the 2020’s. At the current run rate (which includes the infamous mini-budget period) we should be up by 27% decade on decade!!!

(And if by some feat the government DOES manage its 1.5 million new homes by the end of its 5 year parliament, then that’d take us to over 2 million – a massive improvement on the 2010’s)

And by the way, the case for long term funding for social housing…

When you consider that 4.4 million new social homes were built in the 35 years following the end of the second world war (Source: Shelter, UK Parliament), just imagine where we’d be if that level of investment had continued – we’d already have well over 5 million additional social/affordable homes and a much more stable housebuilding sector supporting an army of skilled tradespeople.

James Scott

Managing Director